Background

In today’s rapidly evolving investment landscape, the effective management of fund data is crucial for maintaining regulatory compliance and investor trust. Onboarding, monitoring, and disseminating high-quality, reliable fund data requires the right skills and experience to optimise business operations.

At PryceWilliams we offer specialist consulting and project delivery services tailored to our clients’ fund data challenges, from implementing new fund data procedures to embedding long-term data governance solutions. Our expertise spans vendor assessment, data migration, operational optimisation and regulatory change management. We support investment management organisations that manufacture and distribute investment funds, including:

- Asset managers and investment managers manufacturing and distributing retail or institutional funds.

- Boutique and specialist investment firms requiring operational support for new or existing fund portfolios.

- In-house fund teams within private banks, wealth managers, and investment houses.

- Management Companies and Authorised Corporate Directors seeking to optimise their data governance and ensure compliance with relevant regulatory requirements.

Approach

This guide provides Product, Risk, Reporting and Operations Managers responsible for onboarding, managing and disseminating fund data, with an understanding of:

- The importance of fund data

- The common pitfalls of fund data management

- The services and value that PryceWilliams provides to our clients

We achieve this by addressing the following key questions:

- What is fund data management?

- What are the key phases in the fund data management lifecycle?

- What are the common challenges organisations face?

- What do investment firms need to manage fund data effectively?

- What are the fund data vendors serving the UK market?

Analysis

1. What is fund data management?

Fund data refers to the range of data used to describe and track various attributes of an investment fund. Data may be static, such as fund identifiers and share class data, or dynamic, such as Net Asset Values (NAVs), pricing data or performance metrics.

The management of fund data has a direct impact on regulatory compliance, operational efficiency, speed to market, and client satisfaction. Poorly governed data can lead to reporting errors, product launch delays, increased costs, ineffective decision-making and non-compliance with regulatory requirements.

2. What are the key phases of managing fund data?

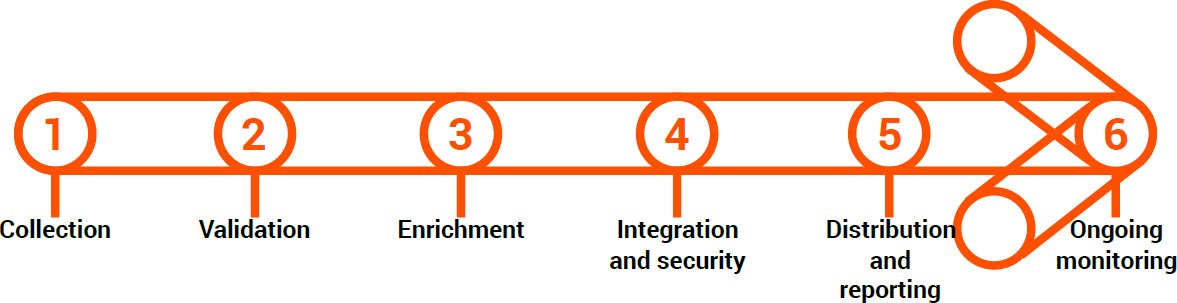

The fund data lifecycle follows six critical phases to ensure data accuracy, reliability and usability to support regulatory compliance, business performance and decision-making. Key stakeholders across the phases will include teams in Product, Operations, Risk, Reporting, IT and external parties such as Custodians and the Fund Data platform provider.

3. What are the common challenges organisations face?

Each phase in the fund data lifecycle has its own activities and risks. Inefficiencies at any stage increase operational burden and risk exposure. In our experience, organisations will face the following:

| Phase | Common Challenges |

|---|---|

| Data collection & ingestion |

|

| Data validation & quality control |

|

| Data enrichment & transformation |

|

| Integration, storage & security |

|

| Distribution, reporting & disclosure |

|

| Ongoing monitoring, audit & governance |

|

4. What is required to manage fund data effectively?

Effective fund data is achieved by combining the right people, processes and technology. This involves:

- Data: Establishing a single golden source consolidating static and dynamic fund data.

- Data governance: Clearly defined roles (data owners, stewards), policies, and accountability structures.

- Expertise: Embedded domain specialists with deep knowledge across product, operations, risk, and regulatory compliance roles.

- Platform: Scalable, secure platforms to manage the fund data lifecycle.

- Processes: Clear, repeatable workflows driving transparency, control, and continuous improvement across the entire fund data lifecycle.

- Governance & change leadership: Strong executive sponsorship, clearly defined roles, cross-functional accountability frameworks, and people-centric change management to drive change.

5. Who are the fund data vendors serving the UK market?

Fund data vendors and their platforms play a key role in fund data management. The following table provides a comparison of some of the key vendors in the UK market (not exhaustive):

| FE fundinfo | Broadridge | Kneip | LPA | Fund Hive | |

|---|---|---|---|---|---|

| Website | fefundinfo.com | broadridge.com | kneip.com | l-p-a.com | spectrags.com |

| Headquarters | UK | US | Luxembourg | Germany | UK |

| Factsheets / marketing docs | ✔️ | ✔️ | ✔️ | Focused on regulatory reports | ✔️ |

| Regulatory disclosure docs (KID, KIIDs, Prospectuses, SFDR, etc.) | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Regulatory data templates (EMT, EPT, MiFID II, Solvency II, TPT, etc.) | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Data Management & integrations | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Document generation | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Distribution & filing | ✔️ | ✔️ | ✔️ | Partial; mainly via templates | ✔️ |

| Registration & filing services | ✔️ | ✔️ | ✔️ | ✔️ | Adhoc support |

| Client portal / web delivery | ✔️ | ✔️ | ✔️ | Portal mainly for regulatory output | ✔️ |

| Analytics / BI | ✔️ | ✔️ | Minimal analytics | ✔️ | ✔️ |

| Translations (multi-language) | ✔️ | ✔️ | ✔️ | Mainly English templates | ✔️ |

| Cost calculations (ongoing charges, MiFID II, transaction costs) | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Key differentiator | Global reach & strong automation | Scale + enterprise client base | Distribution network & EU filings | Deep reg reporting automation | Smaller platform offering flexibility |

Conclusions

Organisations exploring their fund data opportunities should carefully consider the following to ensure effective operations:

- Thorough review of your data foundations.

- Focus on cross-functional expertise and stakeholder alignment.

- Evaluate technology platforms with business readiness in mind.

- Embed repeatable, transparent fund data processes.

- Prioritise robust data governance and continuous monitoring.

Recommendations

At PryceWilliams, we combine project management with deep fund data expertise to address your fund data challenges across the full lifecycle. Here’s how we help:

| How We Can Help | What That Means |

|---|---|

| Bridging business & technology | Translate regulatory and business requirements into actionable delivery; ensure alignment across investment teams, compliance, IT, and vendors. |

| Programme & change management | Deliver complex fund data projects (launches, migrations, upgrades) on time and on budget, with robust governance and vendor coordination. |

| Data operating model & process optimisation | Design efficient data flows (pricing, holdings, ESG, risk); streamline reporting workflows; reduce duplication and errors. |

| Regulatory & client reporting readiness | Align fund data to support UCITS, AIFMD, PRIIPs KID, SFDR and ESG reporting requirements. |

| Stakeholder engagement & training | Drive adoption of new processes and tools across front-office, risk, compliance, and reporting teams. |

| Independent oversight | Provide objective assurance that platforms and vendors deliver as promised, protecting the organisation’s commercial and operational interests. |

Whether you are a new entrant or an established investment management organisation, treating fund data as a strategic asset requires an integrated approach. Ensuring the quality of data minimises compliance risks, supports product launches and enhances market trust.

Case Studies

The following case studies highlight successful fund data-related projects supported by our team, demonstrating our knowledge and experience. Our approach to delivery helps clients overcome challenges and achieve their goals while minimising risks:

- Our team supported a major European investment manager with the annual regulatory refresh of PRIIPs Key Information Documents.

- We helped a global asset manager enhance its fund data processes by leading the fund data vendor selection process and migration.

- We partnered with a leading asset manager to migrate its fund data services across vendors and implement a streamlined Target Operating Model, boosting data quality and operational efficiency.

Next Steps

At PryceWilliams, we specialise in supporting investment management organisations unlock the full potential of their fund data. Whether launching new funds, migrating platforms, or navigating regulatory complexity, our people-led approach ensures your projects are in safe hands. Contact us today for a confidential discussion to address your unique fund data challenges, identify opportunities and make progress happen.